The Excellence is a never

ending Search

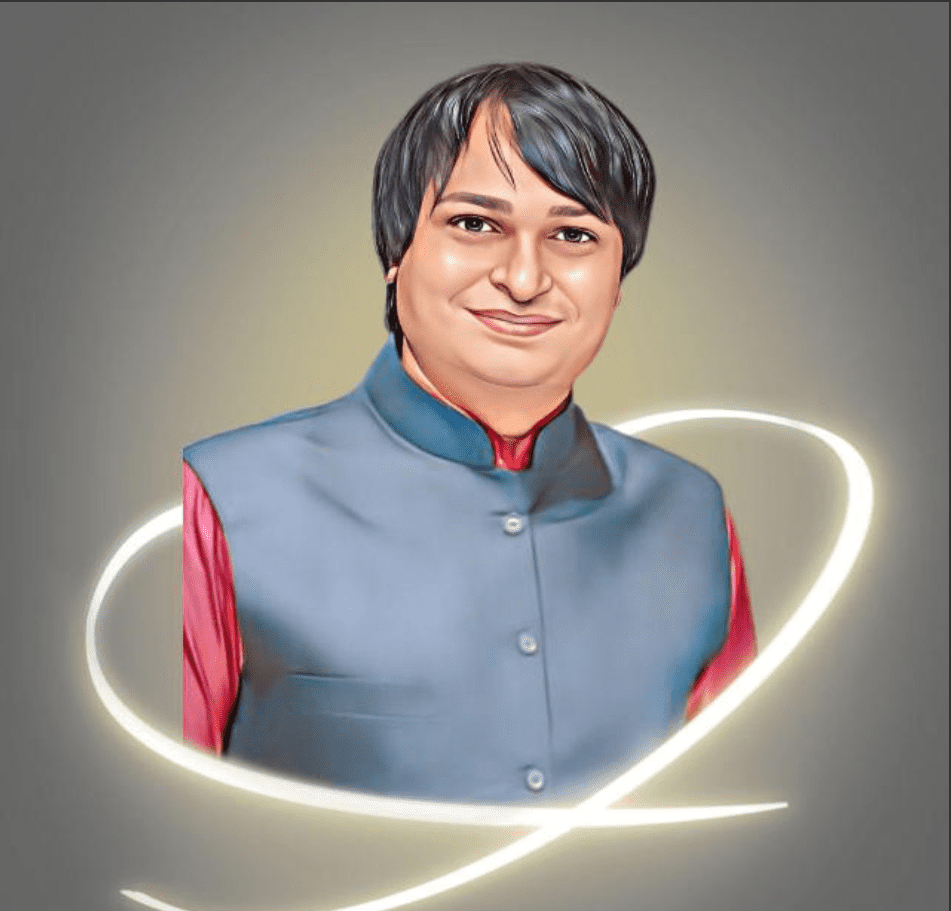

Mr. Ganpat Dhameliya

Founder

Anti-Money Laundering (AML) and Know Your Customer (KYC) are two essential components of regulatory compliance in the banking sector. They aim to prevent money laundering, terrorist financing, and other illicit activities by ensuring that banks have a thorough understanding of their customers and their financial transactions.

The key objectives of AML and KYC in the banking sector are:

Banks employ various tools, technologies, and dedicated compliance teams to implement AML and KYC procedures effectively. These measures may include identity verification software, transaction monitoring systems, risk assessment models, customer screening against watch lists, and periodic reviews of customer profiles and activities.

Client module giving your customers full control over their transactions and account information online and Administration module providing your staff with flexible and powerful account administration tools.

is a comprehensive Internet-based solution that addresses the core banking, treasury, wealth management, consumer and corporate e-banking, mobile banking and web based cash management requirements of universal, retail, corporate, community and private banks worldwide.

International banking marketplace has been experiencing drastic changes. However, never before have there been so many demands on banks to satisfy their customers, manage their internal risks, work cost effectively and protect their competitive position.

Copyright © 2023 Ashvi LLP | Powered by Ashvi Consultancy Service

Design By Dassys