The Excellence is a never

ending Search

Mr. Ganpat Dhameliya

Founder

Mobile banking refers to the use of mobile devices, such as smart phones or tablets, to perform various banking activities and transactions remotely. It allows customers to access their bank accounts, manage finances, and conduct banking operations through dedicated mobile banking applications or mobile-optimized websites provided by their respective banks.

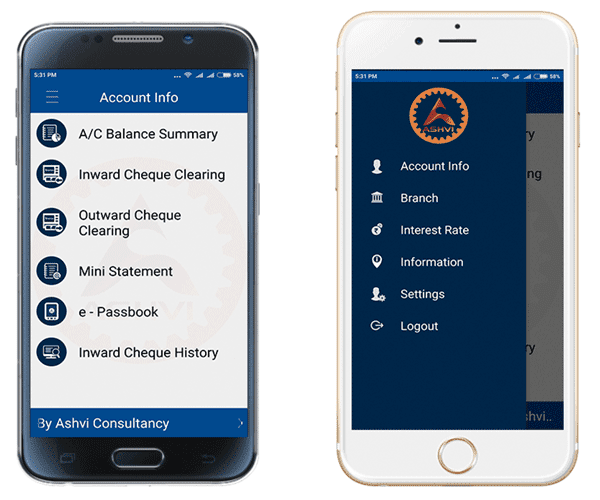

Some common features and functionalities of mobile banking include:

Mobile banking offers convenience, accessibility, and flexibility, allowing customers to manage their finances anytime and anywhere. It has become increasingly popular as smart phones have become more prevalent and internet connectivity has improved. However, it's important for users to follow best practices, such as using secure networks, keeping their mobile banking app up to date, and practicing good password hygiene, to protect their financial information.

Client module giving your customers full control over their transactions and account information online and Administration module providing your staff with flexible and powerful account administration tools.

is a comprehensive Internet-based solution that addresses the core banking, treasury, wealth management, consumer and corporate e-banking, mobile banking and web based cash management requirements of universal, retail, corporate, community and private banks worldwide.

International banking marketplace has been experiencing drastic changes. However, never before have there been so many demands on banks to satisfy their customers, manage their internal risks, work cost effectively and protect their competitive position.

Copyright © 2023 Ashvi LLP | Powered by Ashvi Consultancy Service

Design By Dassys