The Excellence is a never

ending Search

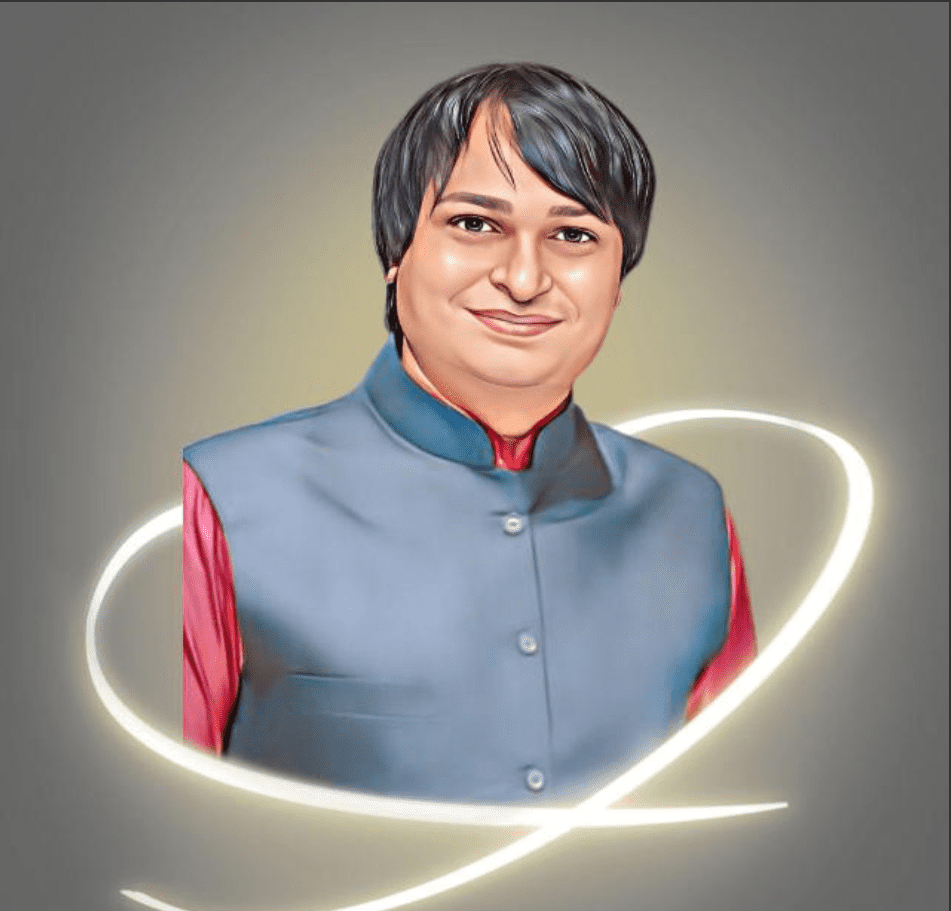

Mr. Ganpat Dhameliya

Founder

Internet banking, also known as online banking or e-banking, refers to the process of conducting banking activities and financial transactions over the internet. It allows customers to access their bank accounts, manage their finances, and perform various banking operations using a computer or a mobile device connected to the internet.

Here are some common features and benefits of internet banking:

To use internet banking, you typically need to have an account with a bank that offers online banking services. You will need to sign up for internet banking and create login credentials (username and password). Some banks may require additional authentication methods, such as OTP (One-Time Password) or biometric verification.

Client module giving your customers full control over their transactions and account information online and Administration module providing your staff with flexible and powerful account administration tools.

is a comprehensive Internet-based solution that addresses the core banking, treasury, wealth management, consumer and corporate e-banking, mobile banking and web based cash management requirements of universal, retail, corporate, community and private banks worldwide.

International banking marketplace has been experiencing drastic changes. However, never before have there been so many demands on banks to satisfy their customers, manage their internal risks, work cost effectively and protect their competitive position.

Copyright © 2023 Ashvi LLP | Powered by Ashvi Consultancy Service

Design By Dassys